Loans

Federal Direct Loans Program

The Federal Direct Loan Program provides financial assistance for undergraduate students attending post-secondary schools on at least a half-time basis.

All student loans are processed through the new Federal Direct Loan Program (Direct). This means that federal student loans will be funded by the U.S. Department of Education rather than private lenders. As an authorized participant, KCTCS Colleges will ensure students and parents are able to borrow funds to meet their educational needs. However, students and parents are required to take some steps to participate.

Students applying for a Federal Direct Loan for the first time must:

- Complete the Entrance Counseling online.

- Complete a new master Promissory Note online.

- BCTC Students must accept or decline student loan(s) on your self-service account. This must be completed each academic year or whenever a new loan is offered. The amount of loan you accept will be divided into two disbursements. If you are accepting in the Fall, the amount will be split between Fall and Spring semesters.

Private Loans

Bluegrass students who wish to apply for private loans may use the FastChoice website.

- FastChoice for Private Loans

- Self-certification form (PDF, new window) - If you are borrowing a private student loan you must print, complete, and submit this form to your lender. If you need assistance completing section 2 of the form please visit the Financial Aid Office.

C.E. Schell Foundation Loan

Schell Loans are 0% interest loans that help to cover unexpected expenses that would prevent a student from completing their education. Students who are eligible may receive up to $5,000 per academic year ($2,500 per semester).

Loan Exit Counseling and Repayment

Students that are graduating, transferring, or leaving college are required to complete Loan Exit Counseling. Loan Exit Counseling will help you select your Repayment Plan. Repayment of Direct Loans will begin once you have graduated or left college. Most students will have a six month grace period that starts at graduation or upon leaving college. There are lots of options available to students once the repayment process begins. We encourage you to review the materials below and visit our Financial Aid Office to discuss what is best for you.

Standard Repayment

- Equal monthly payments of at least $50 (depending on your loan balance) for up to 10 years.

- You will automatically be enrolled in the Standard Repayment Plan, but you will be

able to choose a different plan if you find one that works better for you and your current situation.

Graduated Repayment

Monthly payments start lower, but increase over time for up to 10 years.

| Years | Monthly Payments |

|---|---|

| 1-2 | $198 |

| 3-4 | $240 |

| 5-6 | $292 |

| 7-8 | $355 |

| 9-10 | $432 |

Loan Repayment Calculator

- Available online at Financial Aid Loan Repayment Calculator

- Input simple data to get your repayment schedule

Graduated Repayment Calculator

- Available online at Financial Aid Graduated Repayment Calculator

- Input simple data to get your graduated repayment schedule

- Reduced monthly payments if you demonstrate a partial financial hardship ( based on loan debt, income, and family size.)

- You must reapply each year.

- At the end of 25 years of repayment and 300 payments, any remaining balance may be forgiven.

- Monthly payment is capped at 15 percent of the difference between our monthly AGI (adjusted gross income) minus 150 percent of the monthly poverty level.

Income-Based Repayment

- If monthly payment is not enough to pay accrued interest:

- Subsidized Loans: The Department of Education will pay the remaining interest for up to 3 Years.

- Unsubsidized Loans: The interest will accrue and be added to your balance at the end of the income-based repayment plan.

Income Contingent Repayment Calculator

- Available online at Financial Aid Income Contingent Repayment Calculator

- Input data to get your repayment schedule

What is Extended Repayment?

- Payments that are fixed or gradually increase over 25 years for loan debt that exceeds $30,000 in FFELP or Direct Loans.

- There are two versions of extended repayment.

- If the borrower has $30,000 or more in federal education loan debt with a single lender, the borrower can get a 25-year repayment term without consolidating.

- Otherwise, borrowers who get a federal direct consolidation loan can get repayment terms based on the amount of debt, such as 20 years for $20,000 to $39,999 in debt, 25 years for $40,000 to $59,999 and 30 years for $60,000 or more in debt.

How does it work?

Here's an example:

| 25 year extended repayment | |

|---|---|

| Student Loan Amount : | $35,000 |

| Monthly Payment: | $243 |

| Interest Paid: | $37,879 |

| Total Paid (Loan + Interest): | $72,879 |

Want more Info?

Check out these websites to find a repayment plan that works for you:

Loan Repayment Calculator

- Available online at Financial Aid Loan Repayment Calculator

- Input simple data to get your repayment schedule

Income Sensitive & Income Contingent

Income Sensitive Repayment

- Monthly payments are based on your income and your total loan amount.

- You need to reapply every year.

- The repayment term is up to 10 years.

- FFELP loans only qualify.

Income-Contingent Repayment

- Monthly payments are based on your income and your family size.

- You will need to reapply each year.

- The repayment term is 25 years.

- Direct loans only qualify.

Income Contingent Repayment Calculator

- Available online at Financial Aid Income Contingent Repayment Calculator

- Input data to get your repayment schedule

What is Consolidation?

- Combines all or some of your federal loans into a single Consolidation loan.

- One monthly payment to make/one servicer instead of multiples.

- May lower monthly payment by giving more time to repay ( but with more interest owed long-term)

- May reduce interest rate and keep time to repay the same (depending on mix

of loans and when/how you consolidate.

What do I need to know about consolidation?

Standard Consolidation

- Any mix of federal student loans Ok

- Available any time once loans in grace or repayment

- Lowers monthly payment by stretching payments over longer period, but means paying more interest long-term.

- Even if considering consolidation, you must make your payments on time until the consolidation has been processed.

Who qualifies for a Loan Forgiveness?

Public Service Loan Forgiveness

- In certain situations, you can have your federal student loans forgiven, cancelled, or discharged.

What is a Loan Deferment?

Deferment

- Allows you to temporarily postpone making payments on your loan.

- If you have a subsidized Stafford loan, the government pays your interest.

- If you have an unsubsidized Stafford or Grad Plus loan, you are responsible for the interest.

Forbearance: When Deferment isn't an Option

- Typically allowed at the lender's or servicers discretion.

- Your payments are temporarily lowered or suspended.

- If you don't pay your interest, it will accrue and be added to your balance at the end of the forbearance, even on subsidized Stafford loans.

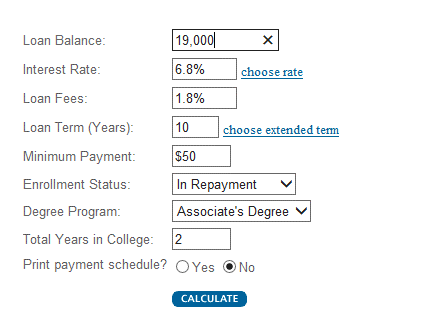

Loan Repayment Calculator

- Available online at Financial Aid Loan Repayment Calculator

- Input simple data to get your repayment schedule

screenshot of loan repayment calculator

Finding Loan Information

Where Can I find Information About My loan?

Students can check on all Financial Aid on the Federal Student Aid website studentaid.gov. You will need your FSA ID and Password (this is the same you use to sign your FAFSA) to login. You will see "My Aid" which details your collective Federal Aid. You can also estimate monthly loan payments and compare different repayment plans.

Contact

Please visit our Contact Us page for more information